Should the Government Impose a Sugar Tax?

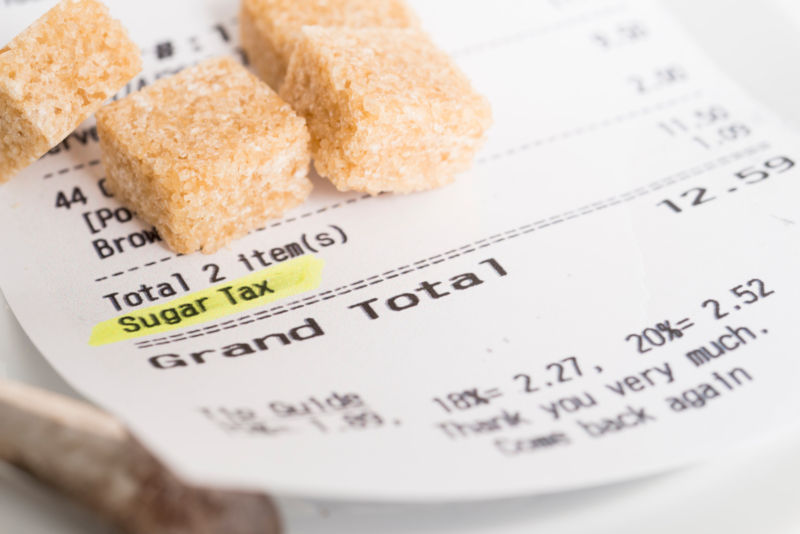

In the UK many people have poor oral health, up to a quarter of children alone are estimated to have tooth decay. This brings up the question, should sugary foods and drinks be taxed? This has been a question that has been debated numerous times over the past few years. In 2018 the UK government imposed a sugar tax on some sugary drinks, however this didn’t include food and drink containing natural sugars and it was specifically put in place for sugary drinks.

Sugar causes many health issues, one of the most obvious problems is the affect it has on oral health. When sugary food and drink is consumed it combines with the bacteria in plaque which produces acid and therefore leads to tooth decay. Official data has show that between 2012 and 2018 there was an 18% increase in children having extractions in hospital. It’s not only children who have a ‘sweet tooth’, statistics show that there are over 12.7 million adult sale and polish appointments each year alone, making it the most frequent dental treatment with adults in the UK.

Both poor oral health and obesity rates have gone up in hospitals, this is not only bad for patients but it also costs a lot of money for healthcare services including the NHS. According to WHO, a tax on sugary drinks in the United States would save American healthcare $17 billion in costs over 10 years.

A sugar tax would save the healthcare service a lot of money in the UK. Furthermore, the money saved could be used towards paying health professionals to go into schools and educate children on healthy eating as well as teaching oral hygiene. The money could also be put into TV advertisements promoting a healthy lifestyle. With a sugar tax in place, people will start to make healthier choices which will result in lower health risks and less strain on the healthcare services.